Easily Analyze the Strategies Behind the Most Popular Options-based ETFs

Quiver Quantitative is now offering Quiver Options, an options strategy analyzer to power your investing or advisory practice. What began as an initiative to breathe transparency into the growing number of available Options-based ETFs has become a tool to transform how Advisors and Retail Investors utilize options to achieve their investment goals.

We spent two years learning how Advisors use options for their clients and built a tool that allows them to see “under the hood” of today's most popular options-based ETF strategies and more.

Does your Options-based ETF justify the higher management fee? ETFs with opaque underlying historical performance—such as covered call, hedged equity, or buffers—can now be “un-wrapped” with Quiver Options.

Actionable Analytics Powered by the Volos Strategy Engine

We partnered with derivatives-focused index provider Volos to leverage their state-of-the-art Strategy Engine, to power a repository of options strategies allowing unprecedented transparency and ease of use.

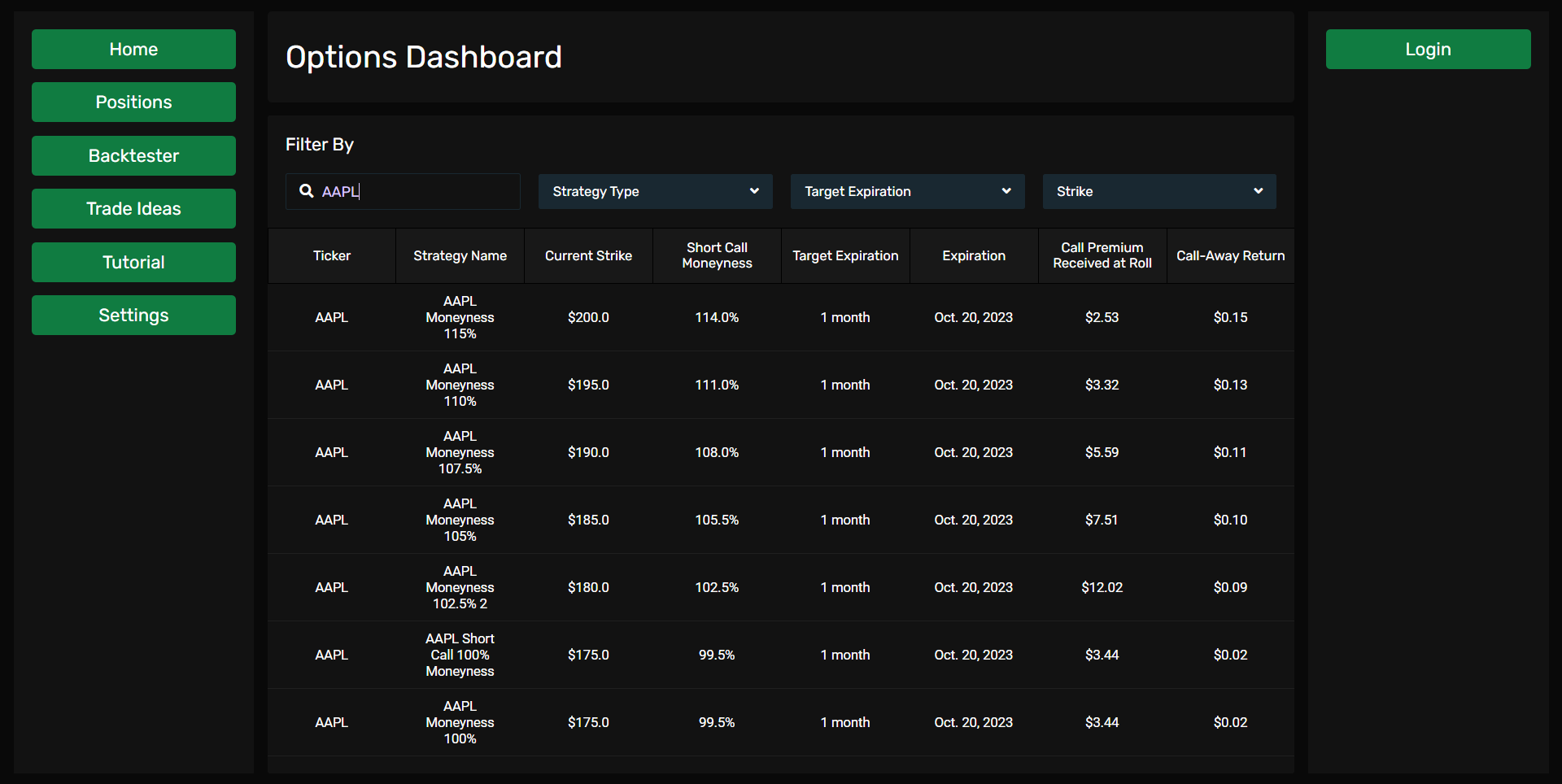

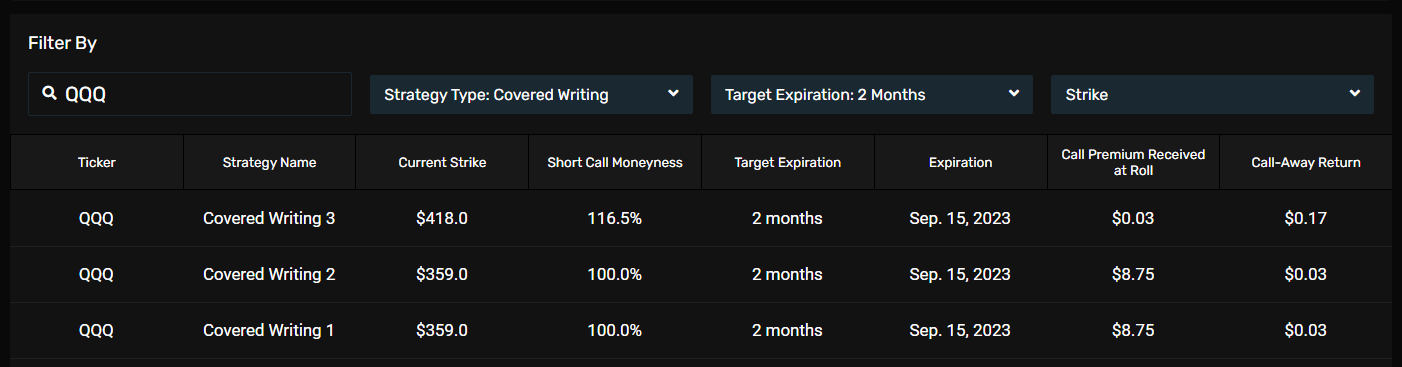

Quiver Options' vast repository already includes detailed analytics and trade data on over 18,000 strategies across more than 400 securities. We run all the strategies ahead of time so all you have to do is search, analyze and follow using an intuitive table view and dropdown menus.

Options Strategies for Every Investment Objective

Quiver Options offers a rich selection of options-based strategies for each security across important parameters to ensure you can tailor strategies to your client's unique needs and goals.

The wealth management industry is increasingly utilizing options strategies to meet targeted investment objectives. Quiver Options features separate modules to tackle the most common investment objectives and their specific nuances.

1. Income

2. Hedging (COMING SOON)

3. Defined Outcome (COMING SOON)

4. Concentrated Stock Position Management (COMING SOON)

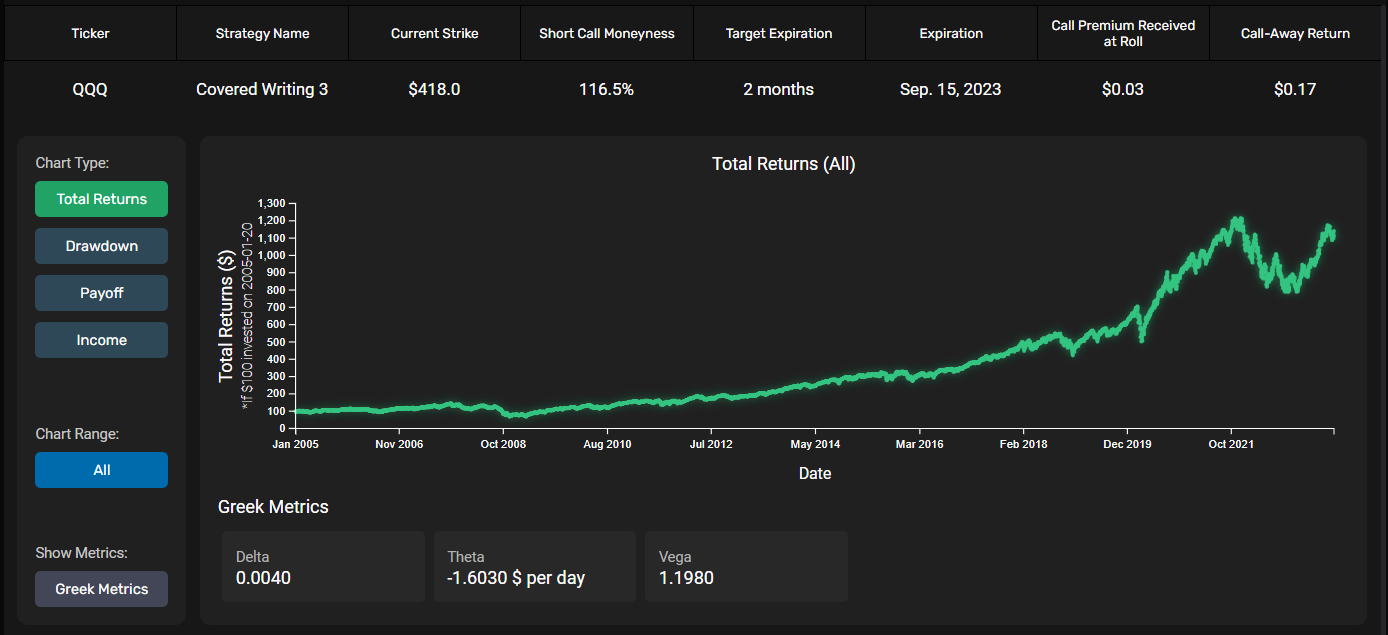

High Integrity Historical Derivatives Analysis to Power Real-Time Investment Decisions.

Quiver Options harnesses the institutional analytical power of Volos' Strategy Engine to provide historical and real-time derivatives analysis of unparalleled fidelity. Selling options over positions or purchasing a hedge comes with trade-offs, ones that ultimately leave you accountable to your clients.

Make informed decisions with confidence, understanding the historical risk/reward profile of each strategy, and provide your clients with the confidence and peace of mind they deserve.

Designed to Power Your Entire Options Practice

Tailoring your client's portfolio with options has never been easier. Quiver Options' Track Strategy feature ensures you're alerted with new trade details ahead of an option's next roll date. Earn back the high management fees of Options-based ETFs and generate real performance for your clients using Quiver Options.